|

|

|

|

| April 25, 2024 |

|

More Americans than forecast filed weekly jobless claims

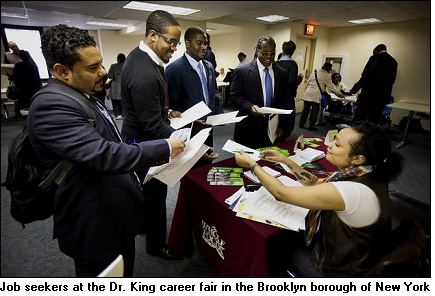

More Americans than forecast filed claims for jobless benefits and sales of previously owned homes unexpectedly dropped, indicating the almost three-year-old economic expansion may be moderating.

Jobless claims fell by 2,000 to 386,000 in the week ended April 14 from a revised 388,000 the prior period, Labor Department figures showed Thursday in Washington. The median forecast of 47 economists surveyed by Bloomberg News called for a drop to 370,000. Purchases of homes fell 2.6 percent to a 4.48 million annual rate in March, the National Association of Realtors reported in Washington. The claims data bolstered Federal Reserve concerns that growth may not be fast enough to sustain improvements in the job market that have helped push unemployment to a three-year low. Other reports today showed that an index of leading indicators rose for a sixth month and consumer confidence improved, while manufacturing in the Philadelphia area grew at a slower pace. “The economy has slowed a notch,” said Ryan Sweet, a senior economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, who is the most accurate forecaster of existing-home sales for the two years through February, according to data compiled by Bloomberg. “We’re just not going to be able to duplicate the growth we saw in the first quarter.” In the U.S., estimates for jobless claims in the Bloomberg survey ranged from 350,000 to 390,000. The Labor Department revised the previous week’s figure up from 380,000. After being revised to 370,000 from an initial estimate of 360,000, the week before that was revised back to 362,000, today’s data showed. States are revising the figures more than usual and as of now there is no explanation for the changes, a Labor Department spokesman said. The repeated revisions may make it more difficult to determine the trend in claims. Residential real estate remains the economy’s soft spot, challenged by stricter lending standards, lower home values and the threat of more foreclosures. Sales of existing single-family homes decreased 2.5 percent to an annual rate of 3.97 million in March. Purchases of multifamily properties, including condominiums and townhouses, fell to a 510,000 pace from 530,000. Existing-home sales, tabulated when a contract closes, climbed to 4.26 million last year, from 4.19 million in 2010. Demand peaked at 7.1 million in 2005 during the housing boom. In 2008, sales totaled 4.1 million, the least since 1995. There were some bright spots in the report. The median price of a previously owned home rose 2.5 percent to $163,800 from $160,600 in March 2011. Borrowing costs Cheaper financing is doing its part to sustain home sales. The average rate on a 30-year fixed mortgage fell to 3.88 percent last week, close to the record-low of 3.87 percent reached in February, according to Freddie Mac data. To help hold down borrowing costs like mortgage rates, Fed policy makers last month said they will continue to swap $400 billion in short-term securities with long-term debt to lengthen the average maturity of the central bank’s holdings, a move dubbed Operation Twist. The program is scheduled to come to a close by the end of June. Policy makers next meet on April 24-25. More optimism Gains in confidence raise the odds that consumer spending will continue to grow and benefit companies like Bed, Bath & Beyond Inc. (BBBY) and Toyota Corp. At the same time, five million more Americans are unemployed now than when the recession began in December 2007, showing why cheerier outlooks will be difficult to sustain. Men, college graduates, homeowners and households earning more than $50,000 a year were among the groups for which confidence climbed last week to the highest level in four years. For those making from $50,000 to $74,999, the index jumped to the highest level since January 2008. There was also a political element as sentiment for registered Democrats rose last week to the best level since August 2007, and that for independents climbed to the highest since December 2007. The index for Republicans last week was 38 points lower than its average dating back to 1990. Retail sales rose more than forecast in March as Americans snapped up everything from cars and furniture to clothes and electronics. The 0.8 percent gain was almost three times as large as projected by the median forecast of economists surveyed by Bloomberg and followed a 1 percent advance in February, Commerce Department figures showed this week. Toyota this month raised its forecast for 2012 industry wide U.S. sales of cars and light trucks, citing rising sentiment. (Source: Bloomberg) Story Date: April 20, 2012

|