|

|

|

|

| May 14, 2024 |

|

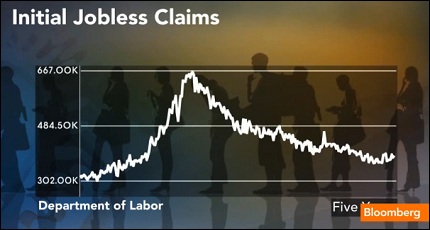

Consumer prices drop by most in 3 years; Jobless claims jump as job market struggles

U.S. consumer prices fell in May by the most in over three years as households paid less for gasoline, possibly giving the U.S. Federal Reserve more room to help an economy that is showing signs of weakening.

The Labor Department said on Thursday its Consumer Price Index dropped 0.3 percent last month after being flat in April. May's decline was the sharpest since December 2008 although analysts polled by Reuters expected a bigger decline. Outside the volatile food and energy category, inflation pressure appeared to be modest. Core CPI climbed 0.2 percent higher as expected, matching the increase posted in April. Mild price increases leave consumers with more money to spend, which boosts economic growth. Lower inflation also gives the Fed more leeway to keep interest rates low. Steady increases in rents for homes and apartments are pushing up core prices, though at a modest pace. Rents are increasing as more people forgo homeownership and rent instead. Gas prices have tumbled 40 cents after peaking April 6. Prices at the pump averaged $3.54 on Wednesday, according to AAA. That's down 19 cents from a month earlier. Still, American workers are seeing little growth in pay. Workers' average hourly earnings have risen just 1.7 percent in the past 12 months, less than the pace of inflation over that same period. Without more jobs or higher pay, consumers could be forced to cut back on spending later this year. Consumer spending is critical because it accounts for 70 percent of economic activity A small amount of inflation can be good for the economy. It encourages businesses and consumers to spend and invest money sooner rather than later, before inflation erodes its value. The economy is growing but at a sluggish pace. That is keeping a lid on price increases. Slow growth makes it harder for consumers and businesses to pay higher costs. The economy expanded at just a 1.9 percent annual rate in the January-March quarter. Lower prices also could make Fed Chairman Ben Bernanke more willing to take action to boost growth. If inflation was threatening to accelerate, Fed policymakers could feel compelled to raise interest rates or take other steps to fight rising prices. But with inflation tame, the Fed can focus on stimulating growth. Jobless claims jump as job market struggles New claims for unemployment aid rose unexpectedly in the latest week, signaling that the labor market remained on the defensive and the recovery was stumbling along. The Labor Department reported Thursday that claims rose a seasonally-adjusted 6,000 to 386,000 in the week ended June 9. Even the four-week moving average, considered a more accurate gauge of the labor market, jumped, gaining 3,500 to 382,000. It was the measure's third straight week of gains. Economists had been expecting new claims to drop to 375,000. "We've been on the higher side for the past two months on average. You cannot explain this away with normal random volatility. It has not been a marked deterioration, but there has been some slippage in the strength in the labor market," Michael Moran, chief economist for Daiwa Securities, told Reuters. The report was another in a series of setbacks for those seeking an improvement in the job market. Among them: President Barack Obama who is running for reelection and needs the economy's cooperation in his battle against his GOP rival Mitt Romney. The rise in jobless claims over the past few weeks suggests that hiring has slowed and the pace of layoffs has quickened as U.S. businesses react warily to a sluggish recovery at home and the financial crisis in Europe. (Source: MSNBC) Story Date: June 15, 2012

|