|

|

|

|

| April 26, 2024 |

|

Alibaba clinches biggest stock debut in history, rising 36% at open

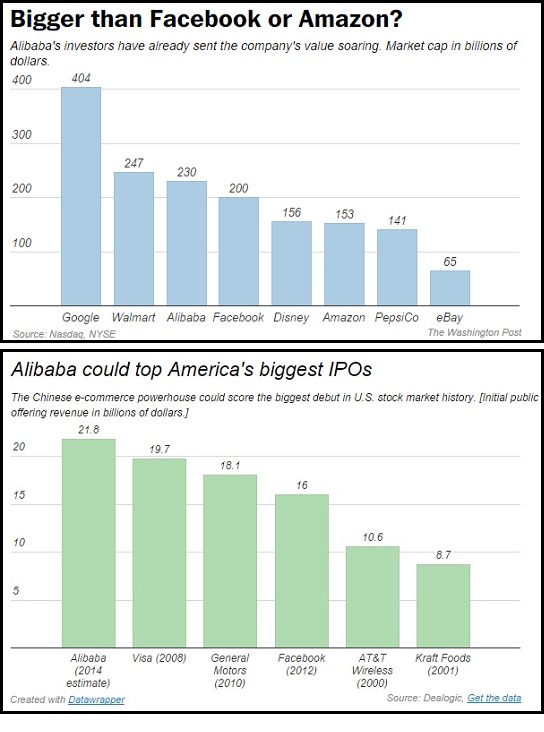

The world’s biggest retail giant, which dominates China’s Web and is making moves on American shores, is expected to raise more than $21.8 billion, and potentially much more, in its initial public offering, or IPO. Shares were priced at $92.70 when trading began around noon, up 36 percent from the initial IPO price.

Trading under the ticker symbol BABA, the megafirm is now valued at more than $220 billion, more than Facebook, Disney or Amazon.com. Alibaba traded more than 100 million shares in its IPO’s first 10 minutes, according to FactSet, with shares peaking at $99 and sliding back a bit to about $90. A group of Alibaba customers, including a Washington state cherry farmer, rang the New York Stock Exchange’s opening bell as investors crowded the trading floor, capping the group’s splashy two-week world tour. Already a household name in China, one of the fastest-growing economies on earth, Alibaba is now pushing hard to show it can compete with the American tech titans who run the digital economy in the West. With its messy, sprawling marketplaces Taobao and Tmall, the Chinese giant was home to more sales last year than Amazon.com and eBay combined. As China’s growing middle class of consumers has found, you can buy pretty much anything on Taobao, including live scorpions and a cashmere dress for your cat. But though 80 percent of online sales in China now go through an Ali¬baba site, the group is just starting to invest in America. They’ve opened a sleek invite-only online boutique, 11 Main, and have invested in Uber ride-sharing competitor Lyft, delivery service Shoprunner and a handful of other tech startups in messaging, luxury retail and video games. “After the IPO, Alibaba will have enough money to buy the coolest and latest innovations to make (it) a true global tech company,” said Simon Chan, a partner in the Hong Kong office of law firm Dorsey and Whitney. “Startup tech companies with cool technologies should be expecting a knock on the door for years to come.” Instead of ringing the New York exchange’s bell, Jack Ma, the group’s quirky, charismatic founder, continued the group’s publicity tour through TV interviews, telling CNBC, “We want to be bigger than Walmart. … They changed the world.” Ma once again touted Alibaba’s mission, “to make it easy to do business anywhere,” by comparing its small-business audience to his founding of the company, in 1999, from within his cramped apartment. “When I was doing my business 15 years ago, no one supported us,” he said on CNBC. To small businesses, he said, “Come to our site, work hard, everything is a fair-play game.” Ma, an impish eccentric who has become a cult figure in China on par with Apple’s Steve Jobs, appeared characteristically energetic, with CNBC’s Jim Cramer calling him “breathtakingly uncynical.” Ma ended his interview by saying, “A lot of young people don’t have dreams anymore. We want to tell them: Those dreams, you have to keep.” (For context, Ma is one of China’s richest billionaires, and has a net worth somewhere around the gross domestic product of Estonia.) But Ma also alluded to routine Alibaba problems, including the marketplaces’ relentless flood of counterfeit merchandise, which once led federal officials to call Alibaba businesses “notorious markets” for intellectual-property fraud. The group has begun to aggressively remove suspected fakes and blacklist problematic suppliers. Of the counterfeits, Ma said, “They are headaches of the world, and we are solving that.” (Source: The Washington Post) Story Date: September 20, 2014

|