|

|

|

|

| April 20, 2024 |

|

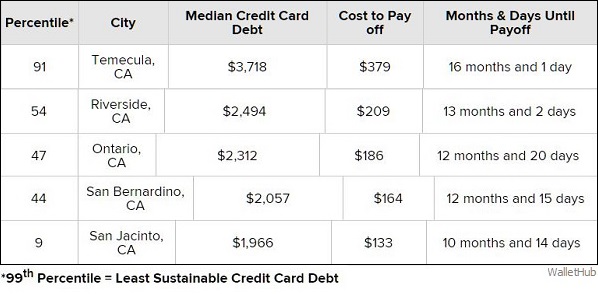

Inland Empire consumers ring up more credit card debt

INLAND EMPIRE – (INT) – Consumers in Riverside and San Bernardino counties are ringing up more credit card debt. But those in other parts of California and the nation are saddled with more.

Americans began the year with more than $1 trillion in outstanding credit card balances for the first time ever, and we are on pace to begin 2019 in even worse shape. Consumers in some cities are better at managing their finances and avoiding overspending than others. WalletHub drew upon TransUnion credit data to calculate the cost and time required to pay off the median card balance. Temecula scored best among the Inland Empire cities surveyed. Consumers in San Bernardino and Ontario took on average a year to pay off their credit card debt which averaged between $2,312 and $2,057. Those in San Jacinto took an average of 10 months to pay off their debt of $1,966. California cities ranking highest were in the more affluent Mill Valley and Marina del Rey. Story Date: January 3, 2019

|