|

|

|

|

| April 26, 2024 |

|

Income tax refunds go unclaimed

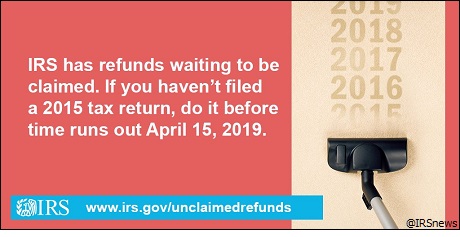

Unclaimed income tax refunds totaling almost $1.4 billion may be waiting for more than a million taxpayers who did not file a federal income tax return for 2015, according to the Internal Revenue Service.

Californians could stand to cash in on $124.4 million or an average refund of $832. To collect the money, these taxpayers must file their 2015 tax returns with the IRS no later than this year's tax deadline, April 15th. “Students, part-time workers and many others may have overlooked filing for 2015. And there’s no penalty for filing a late return if you’re due a refund,” said IRS Commissioner Charles Rettig. The law provides most taxpayers with a three-year window of opportunity to claim a tax refund. If they do not file a tax return within three years, the money becomes the property of the U.S. Treasury. Story Date: April 17, 2019

|