|

|

|

|

| April 24, 2024 |

|

Households pile on more credit card debt

INLAND EMPIRE – (INT) – A credit card TV commercial asks ‘What’s in your wallet?’ An updated study on credit card debt would suggest not very much.

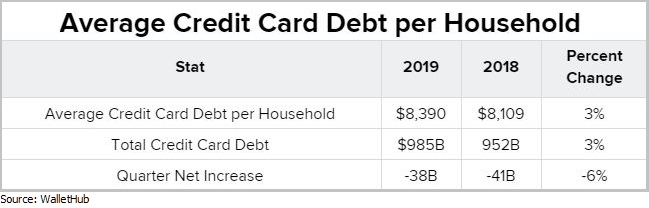

WalletHub found that while Americans paid off $41 billion in credit card debt last year, they ended up owing $67 billion more. The average US household currently owes roughly $8,390. A city-by-city breakdown in the Inland Empire found the more affluent had higher average debt such as Temecula at $17,476 and Chino Hills at $17,386. At the lower end, San Bernardino households averaged $11,527 and Banning at $11,133. In Riverside, it was $14,924. That brought this warning. “If the average household’s credit card balance tops $10,000, that would be a breaking point,” said WalletHub CEO Odysseas Papadimitriou. “At that point, defaults would rise sharply from the historical lows they’ve hovered near for years now. Access to credit would tighten as a result, and consumer spending would slow, causing further economic damage,” he said. Story Date: June 20, 2019

|