|

|

|

|

| May 17, 2024 |

|

PPIC: Coronavirus pandemic will test state’s budget reserves

SAN FRANCISCO – (INT) - Like many households, California faces an uncertain fiscal future because of the COVID-19 pandemic.

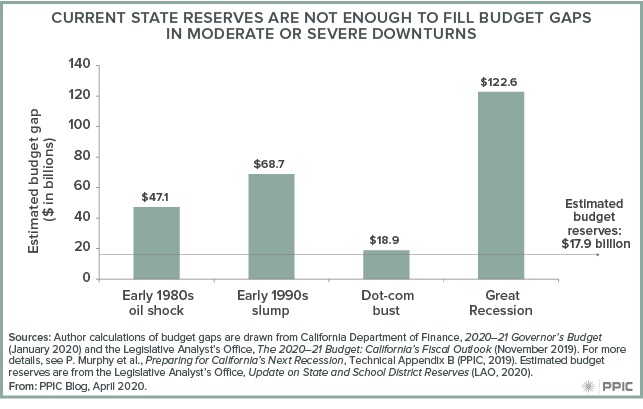

The global crisis has caused a sharp decline in economic activity, exposing crucial sectors to heightened risk. Discussions continue about when and how to re-open the economy. The good news is that California has made important changes to its reserve policies since the Great Recession, according to the Public Policy Institute of California (PPIC). The passage of Proposition 2 (2014) created the Budget Stabilization Account—the state’s rainy day fund—as well as the Public School System Stabilization Account, a separate reserve for K–12 districts and community colleges. In addition, then-Governor Brown and the legislature created the Safety Net Reserve Fund to shore up Medi-Cal and CalWORKs funding during downturns. The bad news is that a severe recession is likely to pose significant budgetary challenges. Drawing from the state’s experience during several recent recessions, the PPIC estimated the budget ramifications of mild, moderate, and severe recessions and the capacity of state reserves to fill gaps. It found that the state’s reserve balance—estimated to be $17.9 billion—is large enough to withstand a mild recession such as the dot-com bust in the early 2000s. However, a long and/or severe recession like the early 1980s oil shock (which lasted four years), or the early 1990s slump and the Great Recession—both of which were much more severe and lasted five years—would create large budget gaps and require policymakers to make difficult decisions. Story Date: May 7, 2020

|