|

|

|

|

| April 26, 2024 |

|

Analysis: Economic recovery from COVID may be long-lasting

SOUTHLAND – (INT) – An analysis by the Southern California Association of Governments (SCAG) paints a sobering picture of economic recovery from the COVID-19 pandemic.

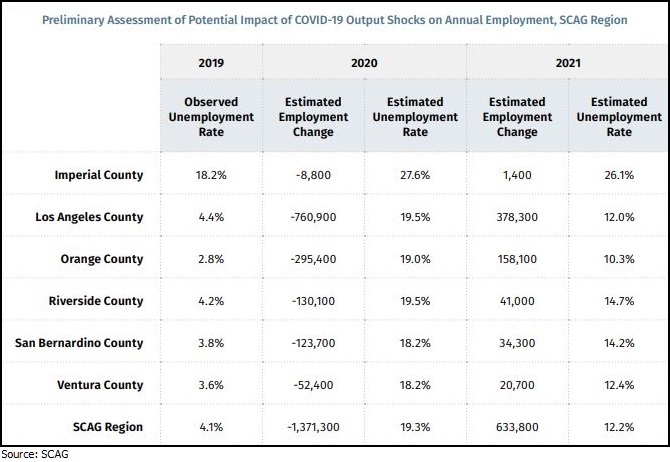

The report projects an annual unemployment rate for the six-county region of 19.3% in 2020, tapering down to 12.2% in 2021. The 2020 rate is particularly significant given that year started with unemployment averaging around 4% in January and February. In April alone, SCAG estimates job loss rates of 20% to 22% – a surge that surpasses the more gradual trendline during the Great Depression, when U.S. unemployment took more than three years to reach its peak of 24.9% in 1933. The analysis also projects decrease in taxable sales of 26% to 38% in 2020 and 2021. In total dollars, those decreases would range from $178 billion to $264 billion, which could severely impact local municipal budgets that rely on sales tax revenues. The forecast models do not take into account the possibility of further waves of infection or the still-unclear impact of government spending on relief efforts. “Even with some uncertainty over how all of this will play out, our analysis suggests that the pandemic’s economic impacts will be severe and long lasting. Understanding this now, and identifying which sectors will be hardest hit, allows us to better plan for the recovery,” said Bill Jahn, SCAG’s President. The assessment shows that job losses are likely to be deeper than those experienced during the Great Recession, and there is little to suggest a quick return to normal tax revenues for local governments. Impacts are likely to be uneven across the jurisdictions of Southern California, not only in terms of their revenue sources but in terms of the vulnerability of their residents to health and economic risks Restaurants will experience the biggest sales impact over the next two years – down a projected 53% to 65%, the SCAG report shows. Significant impacts also are likely to be felt by clothing retailers (down a projected 43% to 57%), car dealers and parts stories (down 38% to 48%) and home furnishing and appliance stores (down 34% to 43%). Supply chain interruptions are another cause for concern, especially in Southern California, where one-third of all jobs and economic activity are tied – directly or indirectly – to the movement of goods. Though there has been a surge in consumption of essential goods since the pandemic began, imports and exports for discretionary cargo have declined substantially. “There is no segment of our economy that is not impacted one way or another by COVID-19, which only emphasizes the need for an inclusive economic development strategy moving forward. The work we do in the coming months will be critical to how quickly and effectively we put this crisis behind us,” said Rex Richardson, SCAG’s 1st Vice President. One sector that could play a significant role in an economic rebound is housing, the analysis shows. While sales have slowed, supplies remain well below demand and most indications are that buyers and sellers are stalling transactions rather than deciding not to buy or sell. Even so, the pace of any recovery is largely going to be determinant on when and how businesses are allowed to reopen and the speed in getting a vaccine to market. The SCAG analysis assumes a severe three-month decline, with the low point occurring on June 1, followed by a longer recovery period. The economic impacts are likely to be felt through the end of 2021, the report says. Story Date: June 7, 2020

|