|

|

|

|

| April 23, 2024 |

|

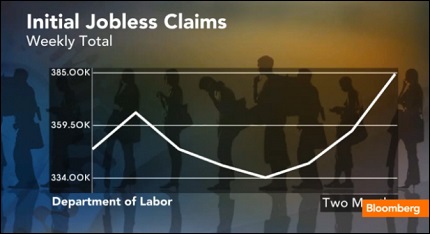

Jobless claims rise 28,000

WASHINGTON--The number of U.S. workers filing new applications for unemployment benefits rose for the third consecutive week, a possible sign of slower growth heading into the spring.

Initial jobless claims, a measure of layoffs, increased by 28,000 to a seasonally adjusted 385,000 in the week ended March 30, the Labor Department said Thursday. That was the highest figure since the end of November. "Whether this is a genuine change in the trend or not, today's data will undoubtedly only compound fears that growth is slowing significantly again," said Jim O'Sullivan, chief U.S. economist at High Frequency Economics. The closely watched four-week moving average of claims, which smooths out week-to-week fluctuations, rose by 11,250 to 354,250, the highest level since the end of February. Federal government spending cuts that went into effect March 1, known as the sequester, may be starting to squeeze the economy. While the report was worse than expectations, economists cautioned that jobless-claims data may have been distorted by technical factors. In particular, Easter and spring break may have inflated last week's numbers—schools, for example, sometimes lay off staff during holidays. A Labor Department analyst acknowledged that spring holidays make it difficult to set seasonal factors. A more widely followed gauge of the economy is due Friday, when the Labor Department releases March's jobs figures. Economists expect payrolls to rise by 200,000 and a steady unemployment rate. That would suggest job growth has slowed only a little from February, when employers added a healthy 236,000 jobs and the unemployment rate fell to 7.7%. If numbers come in lower, businesses and investors may worry that the economy is set for another poor spring—the U.S. has hit a soft patch in each of the last three years. Separate reports out this week highlight the possibility of weaker growth, with manufacturing and service sector activity decelerating in March, according to Institute for Supply Management surveys. Payroll processor ADP said private businesses added only 158,000 jobs last month, falling short of the 192,000 forecast by economists. "With the sequester beginning to bite at this point, the market must take any upticks in initial jobless claims seriously," research firm Wrightson ICAP said ahead of Thursday's release. The Federal Reserve expects the jobless rate to decline only gradually and wants to hold interest rates near zero until unemployment falls to 6.5%. Fed officials have signaled they will continue the central bank's stimulus programs, which also includes $85 billion a month in bond purchases, until they see a "substantial" improvement in the labor market. Thursday's claims data showed the number of continuing unemployment benefit claims, those drawn by workers for more than a week, decreased by 8,000 to 3,063,000 in the week ended March 23. Continuing claims are reported with a one-week lag. The number of workers requesting unemployment insurance was equivalent to 2.4% of employed workers paying into the system in the week ended March 23, unchanged from the prior week. (Source: The Wall Street Journal) Story Date: April 5, 2013

|